Asia-Pacific’s office sector offers compelling opportunities for value-add investments, a new report finds.

In 2024, the issue of building obsolescence gained prevalence as Grade B and lower-tier buildings faced increasing challenges in leasing due to a growing “flight-to-quality” trend among corporate occupiers, according to Knight Frank Asia-Pacific’s latest outlook report, Charting New Horizons – 25 Trends Shaping 2025.

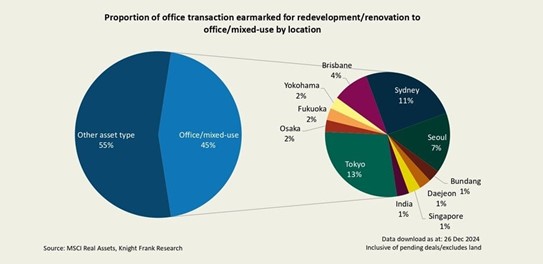

In fact, 45% of office transactions earmarked for redevelopment or renovation over the past year focused on upgrading and enhancing office specifications.

This shift presents significant investment opportunities, particularly in revitalizing older stock by incorporating ESG ( environment, social and governance ) and wellness features.

“The Asia-Pacific office sector is evolving into a two-tiered market, offering opportunities for value-add investors. This transformation is driven by the widening gap between outdated and premium office spaces, increasing focus on sustainability and ESG compliance, and mandatory stock market regulations. Consequently, we are witnessing a sustained demand for ESG-compliant office spaces,” says Christine Li, head of research, Asia-Pacific, at Knight Frank, and author of the report.

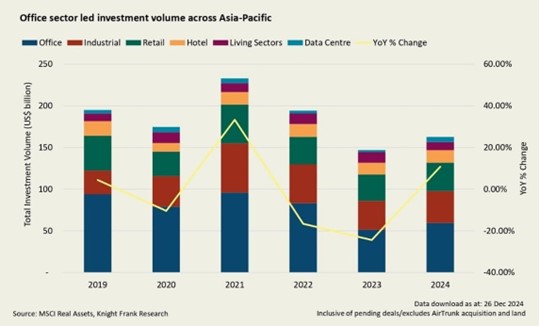

The office sector led investment volume across Asia-Pacific. Annual investment volume in office assets grew 16%, the fastest growing asset class, to reach US$59.5 billion in 2024 from US$51.2 billion in 2023. This growth accounted for 37% of all capital received in the region's real estate market.

A major draw of office assets in Asia-Pacific is the high occupancy rate compared with Western counterparts. Utilization rate averages 80% in the region, far higher than the 65% recorded in major US cities and 70% in the United Kingdom and Europe, the report says.

Data centre boom

Investor appetite for defensive sectors remains strong, with data centres leading alternative real estate investments, despite anticipated rate cuts.

Data centres have consistently ranked first in niche property type prospects, showcasing remarkable growth. In 2024, data centre investments reached US$6.3 billion ( excluding the AirTrunk takeover ), a 2.5-fold increase from US$2.5 billion in 2023. This trend is driven by persistent pricing expectation gaps and narrowing yield spreads, pushing investors towards assets that can meet their return targets.

“Asia-Pacific offers significant investment opportunities in the data centre sector due to strong live supply growth and a persistent supply-demand imbalance,” notes Knight Frank data centre lead Fred Fitzalan Howard.

From 2018 to 2023, the region experienced a compound annual growth rate ( CAGR ) of 19% in live supply, as reported by DC Byte. Yet, the current supply remains insufficient to meet the demands of its vast population’s digital growth. Malaysia continues to lead as the top data centre hub in Knight Frank's SEA-5 Data Centre Opportunity Index 2024, while emerging markets such as Chennai, Melbourne, and Bangkok show promising potential in this sector as cloud service providers and artificial intelligence ( AI ) companies diversify away from tier 1 data centre hubs, Howard adds.

Industrial asset growth

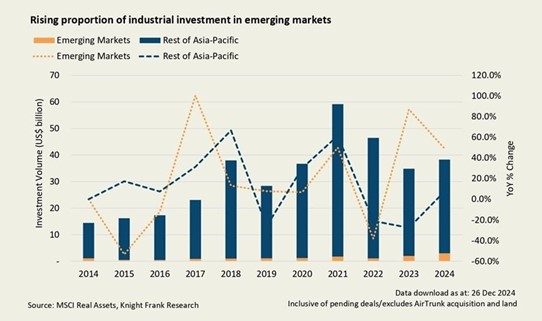

The industrial sector in emerging markets also experienced remarkable growth, with total capital received for industrial assets reaching a record-breaking US$3 billion in 2024, marking a 50% increase from the previous year. This growth significantly outpaced the rest of Asia-Pacific, which saw only an 8% increase during the same period, the report says.

Vietnam emerged as a leading investment destination in the region, leveraging its strategic proximity to China and strong export growth. As Southeast Asia’s largest exporter, Vietnam saw its exports rise from US$320 billion in 2019 to US$440 billion in 2023 at a CAGR of 8.2%, as noted by IHS Markit, driven by substantial foreign direct investment in manufacturing.