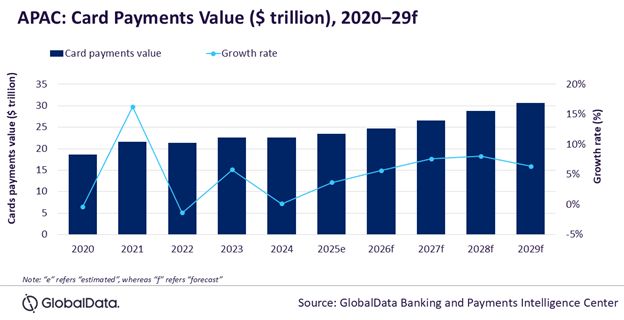

The Asia-Pacific card payments market is forecast to grow at a compound annual growth rate ( CAGR ) of 6.9% over five years to reach US$30.6 trillion in 2029, data and analytics provider GlobalData says.

Card payment value in the region registered a growth of 5.8% in 2023 and reached US$22.6 trillion last year, driven by rising consumer spending and preference for electronic payments.

However, global uncertainty driven by the latest US tariffs may pose a challenge to the overall regional economic growth, resulting in a slowdown in card payment value, which is expected to grow by 3.6% in 2025, according to GlobalData’s payment cards database.

Ravi Sharma, lead banking and payments analyst at GlobalData, comments: “China, South Korea, Japan, and Australia have a robust card payments market with a high card payments value. Other markets within the region are also catching up, supported by improving payment infrastructure, a rising middle-income population, growing financial awareness, and banks offering lucrative benefits in terms of reward programmes and installment facilities.”

China leads market

The APAC card payments market is dominated by China, which is expected to grow at a CAGR of 6.8% to reach US$24.9 trillion in 2029. It is followed by Japan with an expected card payments value of US$1.2 trillion, South Korea with US$1.1 trillion, and Australia with US$895.9 billion in 2029.

A well-developed payment infrastructure and the adoption of newer payment technologies contributed to growth in these markets. For instance, Australia’s contactless card market is highly developed, with strong penetration and awareness of contactless cards. This can be attributed to the widespread adoption of contactless payments in transportation. In February 2025, Public Transport Victoria announced plans to launch contactless payments on public transport in the state of Victoria.

However, card usage is comparatively low in countries such as Indonesia, India, Thailand, and Vietnam. This is mainly due to the limited financial awareness for card payments, inadequate point-of-sale ( POS ) infrastructure, and the growing popularity of QR-based mobile payments.

Governments in these markets are also taking a number of initiatives to strengthen payment infrastructure. The Indian government, for example, offers businesses a subsidy for the installation of payment devices such as POS terminals and QR codes under the Payments Infrastructure Development Fund ( PIDF ) scheme. According to the Payments Council of India's September 2024 report, both QR and physical POS terminals experienced substantial growth, demonstrating the PIDF's positive impact on digital payment adoption.

Challenges to faster growth

However, the high costs of building POS infrastructure for merchants and the high preference for digital wallets among consumers are hindering faster card payments growth in the region.

“Many consumers in the region have leapfrogged from cash to digital wallets, skipping card payments,” says Sharma. “The availability of low-cost smartphones, rising internet penetration, growing awareness of mobile payments, and the proliferation of digital wallets have resulted in Asian countries shifting from cash transactions to mobile digital payments.”

He expects the card payments market in APAC to continue its upward trajectory, driven by ongoing government initiatives, improving payment infrastructure, and a consumer shift towards electronic payments. “However, high preference for digital wallet payments remains a challenge for their faster adoption,” Sharma adds.